The Top 23 Construction Industry Trends for 2025

Jun 6, 2024

Last updated — August 27, 2025

The construction industry is set for significant transformation in 2025, driven by innovative technologies, sustainable practices, and evolving market dynamics. From advancements in digital tools to a stronger focus on environmental responsibility, the landscape is rapidly changing and adopting new construction industry trends.

In this blog, we’ll explore the top 23 construction industry trends shaping the future of construction, offering insights into how industry professionals can navigate and leverage the latest construction industry trends to stay competitive and successful.

Key Takeaways

- Smart technology solves real construction problems: Drones, BIM, and AI reduce project delays by 10-20% while improving safety through predictive analytics and automated monitoring.

- Sustainable building practices deliver measurable ROI: Green construction reduces energy consumption by 40% and operational costs, transforming from optional to an essential business practice.

- Modular construction accelerates project delivery: Prefabrication methods complete projects 30-50% faster while reducing waste by 90% compared to traditional building techniques.

- Integrated digital workflows eliminate inefficiencies: Teams using centralized asset management like OpenAsset submit 46% more proposals annually with higher success rates

Construction Industry Updates for 2025

The construction landscape in 2025 tells a story of strength alongside caution. According to the U.S. Census Bureau, total construction spending in June 2025 stood at $2.136 trillion, marking a 2.9% decline from the same time last year.

Despite the cooling in spending, the Associated Builders and Contractors (ABC) Backlog Indicator remained strong at 8.8 months in July 2025, suggesting contractors still have a reliable pipeline of work. This combination—steady backlogs but tempered spending—signals a construction sector that’s stable on its feet, yet watching macroeconomic pressures and client demand closely. Contractors with agile planning, tight cost control, and diversified project portfolios are best positioned to navigate the second half of the year.

1. Green Building and Sustainability

In 2025, sustainability is a cornerstone of the construction industry. Companies are adopting eco-friendly practices by using green building materials and integrating energy-efficient technologies.

This shift is driven by regulatory demands and a strategic business imperative, as construction clients increasingly seek environmentally responsible projects. From design to completion, sustainable practices are becoming embedded in the construction process.

In fact, policy changes in 2025 have underscored how embodied-carbon procurement is shaping sustainable construction. As Canary Media reported in January 2025, the federal government rolled back its Buy Clean program, sparking concerns over “stalling momentum for low-carbon building materials just as the sector was beginning to scale” . Despite this setback, many states are stepping up, using procurement policies to keep embodied-carbon reduction on the agenda.

Meanwhile, project-level progress shows how these policies translate into practice. A 2025 Carbon Leadership Forum collection highlighted success stories where low-carbon concrete, mass timber, and adaptive reuse projects demonstrated both carbon savings and cost competitiveness—evidence that procurement strategies can deliver climate benefits without sacrificing budgets.

Here are some key benefits of green building:

- Energy Efficiency: Buildings are significant contributors to CO2 emissions, accounting for nearly 40% of global energy-related carbon output. Through green construction, energy consumption and greenhouse gas emissions are substantially reduced.

- Water Conservation: Sustainable building practices include measures that minimize water use.

- Health and Safety: Using non-toxic, sustainable materials enhances the living conditions within buildings, contributing to better health outcomes for occupants.

Despite these advantages, sustainable features often remain viewed as luxuries. However, this perception is expected to shift over the next decade as green technology and sustainable construction practices become more mainstream.

2. Addressing the Labor Shortage

The construction industry is dealing with a significant labor shortage, which has become a central challenge shaping the sector’s dynamics. In 2022, it even reached “crisis level.”

This shortage of skilled labor is prompting collaborative efforts among industry stakeholders, educational institutions, and governments to bridge the skills gap. These initiatives focus on promoting vocational training and attracting new talent, emphasizing the crucial role of skilled workers in tandem with advanced technology.

According to Associated Builders and Contractors, the construction industry needs to hire an additional 501,000 workers to meet labor demands. In the most recent 2024 AGC of America-Arcoro Workforce survey, 94% of firms had open positions for hourly craft workers (up from 85% in the 2023 survey) and 79% had openings for salaried workers (vs. 69% in 2023). reported challenges in filling job vacancies, and 61% experienced project delays attributed to labor shortages.

Despite recovering from workforce losses during COVID-19, the industry faces rising wages due to inflation and a lack of sufficiently skilled workers, highlighting the need for effective training and employee retention strategies.

The labor shortage is exacerbated by demographic shifts within the workforce. Nearly a quarter of construction workers are over 55, with few younger individuals entering the trades. This aging workforce is a critical issue, as replacing older workers does not equate to replenishing lost experience.

Moreover, while robots and automation have taken up some slack (more on this later), the need for technically skilled workers to manage and interpret data from these technologies is growing.

3. Rising Construction Industry Costs

In recent years, the construction industry has faced significant cost volatility, particularly in material costs. Currie & Brown’s report, Building a resilient future: Adapting to uncertainty in 2025, released in February 2025, anticipates global construction cost increases of up to 7% in 2025.

Combined with rising interest rates, these escalating costs are exerting additional pressure on the industry.

Advancements in technology, such as drones, augmented reality (AR), and Building Information Modeling (BIM), are becoming critical in managing these challenges. These tools help maintain project volume by enhancing precision and efficiency, ultimately helping to mitigate some of the cost pressures.

However, the introduction of innovative materials, while promising long-term savings and sustainability benefits, could initially drive costs even higher.

The construction sector also continues to reel from the impacts of global trade disputes, regulatory changes, and supply chain disruptions initially caused by the COVID-19 pandemic.

These factors have led to sharp increases in both material costs and wages, placing further strain on the industry.

Inflation and rising interest rates add another layer of complexity, highlighting the need for strategic planning and cost management within the industry.

By leveraging new technologies and innovative materials, construction companies can navigate these financial challenges more effectively, although the initial investment may be substantial.

Supply Chain and Material Shortages

Recent analyses, including Linesight’s H2 2024 Construction Market Insights – Americas, show that price pressures have begun to stabilize, though key commodities remain elevated. Cement and concrete prices, for instance, are still at historically high levels. Linesight notes that cement costs increased by around 11% year-on-year in 2023 and are expected to see mid-single-digit growth through 2024–2025, driven largely by high energy costs and logistical bottlenecks. Meanwhile, ready-mix concrete prices have also remained firm, reflecting demand from both infrastructure and private sector projects.

Steel and copper prices, which spiked dramatically in 2021–2022, have shown signs of volatility rather than consistent escalation in 2024–2025. However, supply chain constraints and labor shortages continue to add pressure. Linesight’s H1 2025 report also points out that energy availability and power constraints across the Americas are now emerging as critical risks, with potential knock-on effects for production costs in energy-intensive materials like cement, steel, and glass.

Since the onset of the COVID-19 pandemic in 2020, the construction industry has endured ongoing supply chain disruptions and price swings, leading to shortages of critical materials such as steel, lumber, concrete, drywall, insulation, and HVAC equipment. These issues have caused both cost inflation and project delays.

To mitigate these risks, companies should diversify their supplier networks, secure flexible procurement contracts, and explore regional or local sourcing options. Many contractors are also building greater resilience by investing in stockpiling critical inputs and adopting digital tools for supply chain visibility—strategies that help reduce exposure to volatile global commodity markets.

4. Contractor Confidence and Economic Uncertainty

In 2025, contractors are still navigating an uncertain economy shaped by inflation, tariffs, and fluctuating material costs. The Associated Builders and Contractors (ABC) Construction Backlog Indicator has held steady, coming in at 8.7 months in June and inching up to 8.8 months in July, giving contractors a fairly solid pipeline of work to rely on.

At the same time, overall construction spending is starting to cool. In June 2025, total construction spending fell to $2.136 trillion, a 2.9% drop compared to the previous year. Residential projects have slowed, and private nonresidential work is also pulling back. Public sector spending has helped soften the decline, but only slightly, with growth of just 0.1%.

The takeaway for contractors is mixed. Backlogs suggest there’s still work on the books—especially with infrastructure projects keeping crews busy—but the dip in overall spending shows that caution is creeping into the market. Contractors are watching interest rates, material prices, and private investment closely, knowing that agility and smart planning will be critical to ride out the uncertainty in the months ahead.

Construction Industry Growth Rate

The construction market is projected to grow from $10,436.02 billion in 2023 to $16,108.43 billion by 2030, with a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030.

Specifically, the construction market in North America is likely to experience significant growth. This growth is a result of economic expansion, increasing population, and urbanization. Enhanced focus on sustainable practices and government investments in infrastructure also contribute significantly to this growth.

2025 Market Pulse

The latest numbers show a construction market that remains active but under pressure. According to the U.S. Census Bureau, total construction spending in June 2025 was $2.136 trillion, down 2.9% from a year earlier. Private residential spending fell 0.7%, private nonresidential dipped 0.3%, and federal investment dropped 4.4%, leaving only modest gains on the public side at 0.1%.

At the same time, the Associated Builders and Contractors (ABC) Construction Backlog Indicator edged up to 8.8 months in July 2025, suggesting contractors still have a solid pipeline, even as confidence in profit margins and sales expectations cools. Strong demand in infrastructure, manufacturing, and data centers continues to provide stability, but the overall picture shows a sector balancing steady backlogs against tighter spending and cautious investors.

| Hand-picked related content: Curious about more trends in the AEC industry? Read our blog on the Top 17 AEC Trends now. |

5. Enhancing Construction Worker Safety

Safety has always been a priority in the construction industry, but in 2025, there’s a heightened focus on implementing advanced safety measures.

According to the Bureau of Labor Statistics, the construction and extraction sector accounted for 1,055 fatalities, representing 20.0% of all workplace deaths in the U.S.—approximately 1 in 5 worker fatalities in 2023.

However, as the industry embraces a culture of safety, the goal is not only to meet regulatory requirements but to prioritize the well-being of every worker. A key example came in July 2025, when OSHA advanced its long-anticipated Heat Injury and Illness Prevention Standard. This proposed rule would require employers—especially in high-risk sectors like construction—to adopt heat safety programs, provide access to water and shade, and monitor workers for heat stress. OSHA noted that heat is the leading weather-related killer in the U.S., with more than 400 fatalities annually, underscoring the urgency of this new regulation.

Technology plays a pivotal role in worker safety, with wearable devices and AI-powered analytics used to monitor and mitigate potential risks. Virtual reality (VR) and augmented reality (AR) are used for immersive safety training, providing workers with realistic scenarios to enhance their understanding of potential hazards.

6. Construction Industry Technology

Traditionally cautious in adopting new construction technology, the construction industry is increasingly changing its mindset. Among survey respondents in OpenAsset’s 2022 AEC Industry Outlook Survey, nearly 74% of respondents said they plan to implement new technologies to help overcome key challenges.

This shift is being driven by the need to enhance efficiency, especially in the wake of the COVID-19 pandemic, which has highlighted the importance of technological advancements.

In 2025, technology will likely be the biggest differentiator for builders and developers. A survey by GlobalData on construction technology identified several key drivers for this change.

Improving productivity was the most commonly cited reason, with 61% of respondents highlighting it. Other significant reasons included achieving greater competitiveness and reducing costs (both 37%), and enabling faster construction times (35%).

Several types of technology are set to grow in popularity through this year and beyond, each contributing to increased efficiencies:

- Building Information Modeling (BIM)

- Drones

- Augmented Reality (AR) and Virtual Reality (VR)

- Robotics and Automation

- Wearable Technology

- Artificial Intelligence (AI)

These technologies not only enhance efficiency but also improve competitiveness, reduce costs, and enable faster construction times.

As the industry continues to embrace these innovations, construction projects will become more streamlined, safer, and more cost-effective. The implementation of advanced technology is set to transform the construction landscape, driving growth and sustainability in the sector.

AI in Preconstruction and Operations

The rise of artificial intelligence (AI) and advanced technologies is revolutionizing the construction sector. According to Global Market Insights, the AI in construction market value was over $2.5 billion in 2022 and is expected to grow at a 20% CAGR from 2023 to 2032.

From autonomous construction equipment to Building Information Modeling (BIM) and augmented reality (AR), technology is enhancing project efficiency and accuracy.

AI algorithms optimize project scheduling, resource allocation, and risk management, enabling construction companies to make data-driven decisions.

Recent industry signals reinforce the role of analytics in driving strategic action amid shifting market dynamics. Construction starts surged 16% in June 2025, led by manufacturing and data center groundbreakings, while nonresidential construction spending slipped for the sixth time in seven months, marking growing divergence in sector performance.

Key applications of machine learning (ML) and AI in AEC include:

- Predictive modeling for project delays and cost overruns

- Resource optimization, improving workforce and supply chain deployment

- Dynamic risk assessment, adjusting to policy shifts or tariff pressures

- Real-time monitoring, ensuring project viability under rapidly changing conditions

- Strategic planning, spotting high-growth subsectors like data centers before traditional indicators reflect the trend

AI and ML are becoming pivotal in addressing the industry’s most pressing challenges, such as labor shortages, delays, and cost overruns. These technologies can handle large volumes of data for problem-solving and pattern recognition throughout all phases of a construction project.

The construction industry is not just building structures; it’s constructing them with the precision and efficiency made possible by cutting-edge technology. As AI and ML continue to evolve, their impact on construction will only grow, driving further advancements and efficiencies in the sector.

Big Data and Analytics on the Rise

A significant trend in the construction industry is the increased use of big data. The industry generates vast volumes of data, including project specifications, financial information, and employee records.

Recent industry indicators show how critical data has become in shaping construction trends. The Dodge Momentum Index (DMI), which tracks nonresidential building planning, expanded 6.8% in June 2025 and then surged 20.8% in July, hitting a record 280.4. This data-driven index—built on thousands of project reports—shows particularly strong momentum in data centers and institutional projects, underlining how analytics reveal where capital is flowing in real time.

Similarly, sector-specific data illustrate the scale of the chip manufacturing and data center boom. According to the Peterson Institute for International Economics, construction spending for computer and electronics manufacturing in 2024 alone exceeded the combined total of the previous two decades, largely fueled by the CHIPS Act. Building on that, Forbes forecasts that in 2025–26, chip fabrication plants and data centers will remain the primary growth engines for nonresidential construction, even as other sectors lag.

Moreover, financial data analysis allows for better budgeting and cost management, identifying areas where expenses can be minimized without compromising quality. Employee data can also be used to track productivity and safety, ensuring that workers are performing efficiently and adhering to safety protocols.

The integration of big data analytics in construction facilitates real-time monitoring and reporting. This enables project managers to track progress accurately, identify deviations from the plan, and take corrective actions promptly. Furthermore, predictive analytics can forecast future trends and demands, helping companies stay ahead of the curve and remain competitive

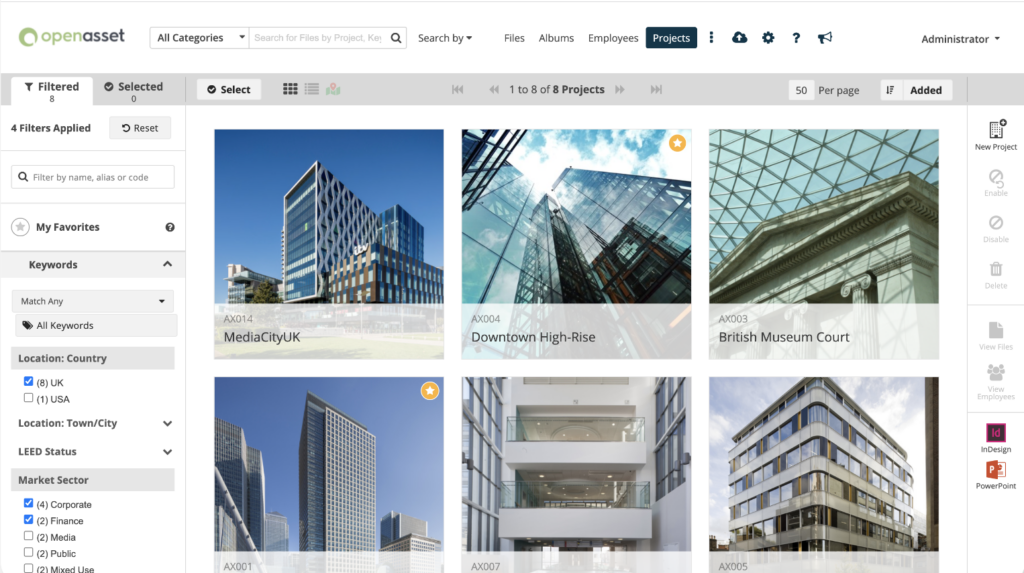

DAM Software

In 2025, Digital Asset Management (DAM) software is becoming a key trend in the construction industry. DAM systems designed with AEC professionals in mind help construction firms manage, organize, and share digital assets efficiently.

These tools streamline project workflows by providing centralized access to critical documents, images, and videos. In turn, this makes the construction bidding process more efficient, helping you create winning proposals while cutting costs and the time spent on each proposal.

In fact, teams that use proposal software have an average 45% proposal win rate and submit an average of 46% more responses every year.

By adopting DAM software, your construction business can improve productivity, ensure consistency in branding, and maintain a comprehensive project documentation archive, making it easier to access and share information across teams.

| Hand-picked related content: New to DAM? Want to know how to compare digital asset management software? Read our DAM Software Buyer’s Guide now. |

7. Construction CyberSecurity Risks

As construction firms embrace digital transformation with cloud-based project management, IoT-enabled equipment, and integrated supply chains, they are becoming increasingly attractive targets for cybercriminals. In the first half of 2025, construction ranked among the hardest-hit industries in the U.S., with 97 reported ransomware cases, while phishing attempts and data leaks remain common attack vectors.

The sector’s vulnerability stems from its reliance on sensitive, high-value data—from designs to financials—combined with often limited cybersecurity maturity. According to NordLayer, 76% of attacks on construction firms are financially motivated, with additional cases tied to espionage and sabotage. In the UK, reports found that 27% of businesses in connected buildings experienced cyberattacks in 2024, up from 16% the year before, underscoring how IoT devices and building systems are a growing target.

Mitigating these risks requires a proactive approach. Best practices include enforcing multifactor authentication, applying “least privilege” access, and performing rigorous vendor and supply chain audits. Developing formal incident response playbooks and investing in cyber insurance tailored to construction firms are also increasingly recommended.

With ransomware on the rise and digital systems now integral to project delivery, cybersecurity is no longer just an IT concern but a core operational priority. Firms that adopt layered protections and embed digital risk management into daily operations will be better positioned to safeguard project continuity, protect sensitive data, and maintain client trust in 2025 and beyond.

8. Reality Capture: Drones, Laser Scanning, and 360 Capture

Initially popular for aerial photography, drones now serve a multitude of purposes far beyond capturing images for real estate and commercial projects.

The global construction drone market has expanded significantly, reaching an estimated USD 5.1 billion in 2024 and expected to grow to USD 5.49 billion in 2025, with a 7.6% CAGR through 2033.

Modern drone use quickly maps extensive areas, generating valuable aerial heat maps and thermal images. The advancement in drone software provides real-time, actionable data, streamlining decision-making and enhancing the construction process. This rise in drone-enabled construction monitoring reflects a broader industry shift toward efficiency, safety, and sustainability. When integrated with other technologies—like IoT sensors, BIM, AR, and VR—drones provide powerful oversight, from precise project tracking to safety inspections. AI and machine learning enhance this further, predicting potential issues and optimizing resource allocation.

Specifically, drones help with tasks including:

- Site Surveying: Facilitating mapping and planning before work begins, saving time and costs by eliminating the need for physical site investigations.

- Progress Tracking: Offering live views of construction sites, allowing developers and contractors to identify and address potential issues early.

- Project Documentation: Creating accurate records of construction progress.

- Safety Inspections: Identifying potential hazards to prevent accidents.

- Worker Monitoring: Ensuring compliance with safety guidelines.

Future advancements in drone technology are promising. Beyond current applications, drones are expected to monitor equipment depreciation and use AI to manage moving construction machinery more efficiently. They are also being paired with laser scanning and 360° image capture, giving project teams precise digital twins and immersive site records that enhance collaboration, accuracy, and long-term asset management. Combined with well-structured architecture proposals that set clear expectations on scope, budget, and timelines, these technologies create a more transparent, data-driven framework that reduces risks and supports project success.

9. Construction Robotics and Automation

The adoption of robotics and automation in the construction industry is increasing as firms seek to enhance their workforce with technological solutions.

The construction sector remains highly labor-intensive, involving many repetitive and time-consuming tasks that are prone to human error and fatigue. This is where robotics and automation come in.

Automation can reduce rework by up to 30% and improve overall project quality by 20%.

Moreover, according to Market.us, the global Construction Robot Market is set to experience substantial growth, expected to rise from $1.4 billion in 2023 to around $8.0 billion by 2033. This expansion represents a Compound Annual Growth Rate (CAGR) of 19.1% from 2024 to 2033.

Robotics and automation offer a way to streamline construction processes. How will construction companies use robots exactly? Here’s what the Market.us data says:

- Over 60% for 3D printing, concrete placement, and rebar installation

- Approximately 65% for welding, cutting, and surface finishing tasks

- 50% of major construction sites for bricklaying, tiling, and material handling.

- 60% for painting, plastering, and insulation installation.

- Over 65% for roofing, siding, and window installation.

- Over 70% of construction equipment manufacturers will offer robotic solutions tailored to earthmoving, excavation, and grading.

- The use of autonomous mobile robots (AMRs) for material transportation and logistics on construction sites will likely see a 40% growth from 2023.

Robotics in construction boosts project productivity and decreases labor needs while ensuring safety in performing hazardous tasks. Robots designed like mechanical arms can take over menial and repetitive tasks, such as bricklaying, thereby speeding up construction and reducing human-induced mistakes.

Despite the significant potential of construction robotics, there are still some limitations. Current robotic systems may struggle with navigating certain obstacles or operating in adverse weather conditions. However, as technology evolves, these limitations should diminish.

10. Building Information Modeling (BIM)

Building Information Modeling (BIM) is transforming building planning and design by providing a centralized database for a single shared model, addressing the limitations of traditional methods.

According to Straits Research, the global BIM in construction market size was valued at $3.3 million in 2021. It’s projected to reach $11.8 million by 2030, growing at a CAGR of 15.1% during the forecast period (2022-2030).

Advanced BIM tools, such as 5D BIM and 6D BIM, incorporate cost, time, and energy budgeting overlays, enhancing workflow efficiency and early clash detection. The integration of AR and VR with BIM allows for rapid testing in simulated environments.

Using 3D modeling software that integrates data from various stakeholders improves information exchange and communication, reduces errors, and boosts ROI. These substantial benefits are why BIM’s use is going to continue growing in the construction industry.

According to Intelvision, BIM can reduce construction costs by 10%, reduce the likelihood of budgeting errors by 40%, and shorten construction time by more than 10%.

As a process, BIM has evolved to meet modern construction needs, offering improved design processes and streamlined workflows. This trend is likely to persist as construction firms increasingly recognize its value.

11. Prefabrication and Modular Construction

Prefabrication and modular construction are experiencing a significant boom, with the market projected to reach nearly $110 billion by 2025, driven by a shortage of skilled labor and advancements in technology.

These methods allow for faster construction times, reduced waste, lowered labor costs, and minimized environmental impact.

Moreover, despite challenges from the COVID-19 pandemic, modular construction also offers the benefit of safer, climate-controlled environments for workers. 60% to 90% of the modular construction is completed inside a factory, which mitigates the risk of weather delays for faster construction.

In fact, 90% of businesses that implemented prefabrication report enhanced productivity, superior quality, and greater reliability in scheduling compared to traditional construction methods.

Additionally, statistics indicate that modular construction can decrease waste by as much as 90% relative to traditional building methods. This efficiency in material use makes prefabrication and modular construction notably sustainable.

In terms of speed, projects using these methods can be completed 30-50% faster than those using traditional construction techniques.

This efficiency is due to the ability to conduct multiple project phases at the same time; while modules are being assembled off-site, site preparation can take place simultaneously, substantially reducing the total project timeline.

While prefabrication offers many advantages, it does come with limitations, such as the need for standardized designs and logistical challenges in transporting large modules.

However, its ability to address space constraints in urban areas and enhance worker safety makes it a valuable trend in modern construction.

12. Virtual and Augmented Reality

Virtual, augmented, and mixed reality are revolutionizing the construction industry by enabling professionals to visualize job sites anytime, anywhere. These technologies allow for virtual walkthroughs, offering clients and stakeholders detailed views of projects even if they cannot visit the site in person.

According to a summary in Sci‑Tech Today (April 2025), the AR & VR market is anticipated to grow at a CAGR of 8.97 % from 2024 to 2029, reaching US$62.0 billion in 2029.

Moreover, research indicates that integrating augmented reality (AR) into construction planning can lead to a significant 90% decrease in errors and a substantial 30% boost in efficiency. These findings highlight the impactful role AR technology can play in improving construction processes.

Specifically, AR enhances project staging and makes preconstruction projects tangible for buyers and tenants.

Builders and developers benefit from AR through wearable technology and 360-degree video, which enable 3D visualization of projects, automated measuring, and quick simulations of architectural changes.

Additionally, AR provides effective safety training and hazard simulations. These technologies also support remote work sites and mobile access, further increasing their value in modern construction practices.

13. 3D Printing

3D printing is becoming increasingly significant in the construction industry. The global 3D printing construction market is likely to grow at a compound annual growth rate (CAGR) of 65.25% from 2023 to 2032, reaching $519.49 billion by 2032 while in 2022, the market value was at $3.42 billion.

3D printing in construction, or additive construction, involves using construction printers to build structures or prefabricate components layer by layer with advanced materials. This method offers significant benefits, such as reduced waste, quicker turnaround times, and the ability to produce custom designs without changing machinery.

Techniques like extrusion, powder bonding, and additive welding are used, resulting in less waste and reduced labor requirements compared to traditional construction methods. In fact, in 2022, the extrusion segment of 3D printing generated more than 63% of revenue.

Although mass-scale 3D-printed homes are not yet common, prototypes of mansions and office buildings have been successfully printed in record time. As of March 2023, there were 129 3D-printed buildings on 105 construction sites around the world, with 54 new buildings added in 2022.

Moreover, this automated, programmable approach minimizes human error and enhances productivity. Startups are now producing 3D printers and offering printing services for both small-scale and large-scale projects.

With its sustainable and efficient building capabilities, 3D printing is a trend to watch in the construction industry.

14. Connected Construction Sites

Connected construction sites are revolutionizing project management by integrating people, processes, and information through technologies like AR, VR, AI, robotics, and wearables. This integration ensures structured workflows and data accessibility at every stage, providing stakeholders with vital information.

IoT and AI enhance predictive logistics, improving worker safety and optimizing inventory, thereby reducing waste and costs. Computer vision enables real-time support, linking construction sites with main offices for quicker, data-driven decisions.

The advantages of connected construction sites include real-time communication, resource sharing, and centralized activity monitoring, leading to improved efficiency, safety, and cost reduction.

15. Smart Cities

Leading tech companies like IBM, Microsoft, and Cisco are heavily investing in megaprojects to build smart, sustainable cities. These cities require extensive planning and development, making them more intricate and interconnected than traditional projects.

Notable megaprojects include:

- Masdar City in the UAE

- Songdo International Business District in South Korea

- Hudson Yards in NYC

- India’s Delhi-Mumbai Industrial Corridor

These projects, costing tens of billions to over $100 billion, aim to boost the economy, improve infrastructure, and enhance environmental health. In fact, cities embracing Smart City solutions could enhance their energy efficiency by 30% over two decades.

Smart cities incorporate high-tech solutions to connect people, data, and city elements, improving eco-friendliness, the economy, and quality of life. This trend requires construction companies to elevate their technical expertise to keep pace with developments like pedestrian sensors and WiFi-enabled lighting.

The global smart building market, driven by the concept of smart cities, is predicted to reach $328.62 billion by 2029, growing at a rate of 22.2% annually. This shift will spur the development of intelligent and connected infrastructure, revolutionizing urban living.

16. Home Building Trends and Residential Projects

In 2025, the home building and residential projects sector will grow significantly. Residential construction spending increased by nearly 25% in 2021, and residential starts were projected to rise by 7% in 2022.

Moreover, builders are increasing construction to meet the demand from buyers frustrated by the lack of existing inventory. Incentives such as mortgage buydowns and assistance with closing costs are making new homes more attractive.

The market share of new-home sales has surged, with single-family housing starts predicted to rise by 4.7% in 2024 and 4.2% in 2025. Townhome construction is also booming, providing more affordable options and addressing space constraints in urban areas.

17. Advanced Building Materials

The global advanced building materials market value was at $56.7 billion in 2021 and is likely to reach $111.7 billion by 2031, growing at a CAGR of 6.8% from 2022 to 2031

The construction industry’s shift towards modular and eco-friendly methods is driving the adoption of advanced building materials. Innovations like 3D-printed concrete and basalt are replacing traditional materials.

Moreover, startups are exploring durable, low-maintenance, and energy-efficient materials. Notable examples include:

- Graphene: Stronger than steel, excellent for lightweight coatings, thermal conductivity, and improving energy efficiency.

- Calcium Silicate Board: Made from sand, clay, and lime; fire, moisture, and pest-resistant, and non-toxic.

- Bendable Concrete (ECC): Contains polymer-derived fibers, has a smaller carbon footprint, and is cost-effective.

- Engineered Timber: Combines several types of softwood to create a strong alternative to steel and concrete, reducing emissions and waste.

- Recycled Materials: Used in constructing small structures.

- 3D Printed Materials: Employed in making concrete walls and floors, with potential for small-scale buildings.

More cutting-edge materials include:

- Aerogel

- Spider silk

- Carbon composites

- Hydroceramics

- Nanomaterials

Advanced wood and aluminum materials like bamboo, cross-laminated timber, transparent woods, and aluminum foam offer enhanced strength and biodegradability.

These advanced materials enhance sustainability, efficiency, and durability in modern construction practices.

18. Innovative Construction Materials and Techniques

The construction industry is rapidly evolving with the adoption of innovative materials and techniques aimed at enhancing sustainability, efficiency, and durability.

Here are some notable examples:

- Self-Healing Concrete: Uses bacteria to repair cracks, extending the lifespan of structures and reducing maintenance costs.

- 3D-Printed Concrete: Enables rapid and cost-effective construction of complex shapes and structures.

- Graphene: A lightweight, strong material used for coatings and improving thermal conductivity in buildings.

- Engineered Timber and Cross-Laminated Timber: Sustainable alternatives to traditional materials, providing high strength and reduced environmental impact.

- Nanomaterials: Enhance the properties of construction materials, improving durability and performance.

- Mycelium Composites: Eco-friendly materials made from fungi, offering sustainability and biodegradability.

- Transparent Aluminum: A strong and lightweight alternative to glass, providing enhanced security and durability.

These construction industry trends are driving significant improvements in construction, offering innovative solutions for modern building challenges.

19. Living Materials

Living materials, also known as biological building materials, incorporate live organisms in their composition. These materials, developed with the help of microorganisms, can grow, heal cracks, and absorb toxins from the air.

This innovative sector is advancing rapidly, with applications ranging from self-healing concrete to reactive paints. Living materials offer significant environmental benefits, helping to reduce the construction industry’s carbon footprint.

Cement production, responsible for 8% of global CO2 emissions, is a key target for these innovations. Self-replicating concrete and biocement, which absorb CO2 during its production, are in development to address these issues.

The adoption of living materials is still in its early stages, but their potential to reduce greenhouse gas emissions and provide sustainable building solutions is promising.

With the global building stock expected to double by 2060, implementing living materials into construction practices could play a crucial role in meeting climate goals.

20. Infrastructure Improvements and Investments

Despite a 50% increase in US GDP from 2015 to 2040, current spending trends suggest the US will meet only 69% of its infrastructure needs. Global infrastructure investment needs to reach $94 trillion by 2040 to keep pace with profound global economic and demographic changes.

Moreover, globally, the population is projected to grow by nearly two billion by 2040, driving a pressing need for infrastructure to ensure access to clean water, housing, sanitation, and more.

Figures from the OECD indicate that $6.9 trillion per year is necessary until 2050 to invest in infrastructure that meets development goals and supports a low-carbon future. This need, coupled with the growing global population, presents a significant challenge.

However, the Global Infrastructure Hub’s “Infrastructure Monitor 2023” report reveals that private investment in infrastructure projects in primary markets recovered, and in some sectors, exceeded pre-COVID-19 levels. Transactions increased by 30%, with an overall value that was 41% higher than the five-year average.

Infrastructure improvements and investments are critical construction industry trends shaping the future. Infrastructure remains an attractive and resilient investment, especially during periods of high inflation and economic uncertainty.

21. Private Equity’s Impact on Construction

Private equity has significantly influenced the construction industry, providing essential capital and strategic guidance. In 2023, global private equity and venture capital investment in the construction and engineering sector totaled $1.77 billion for the year to September.

Private equity firms contribute significant financial expertise and industry knowledge to construction projects.

By pooling funds from institutional investors and high-net-worth individuals, private equity firms inject substantial capital into construction companies, enabling them to undertake ambitious projects and expand their market presence.

These investments not only enhance a company’s financial stability but also bring valuable industry expertise and mentorship. For example, in 2025, Mace Group sold a 75% stake in its consulting arm, Mace Consult, to Goldman Sachs’ private equity fund in a deal valuing the business at nearly $1 billion. The move highlights how private equity can help established players unlock capital for expansion while repositioning their core operations. With Goldman’s backing, Mace Consult aims to triple its workforce over the next five years, while Mace’s construction arm remains debt-free and focused on its contracting business.

Private equity is also exploring emerging markets, contributing to global infrastructure development and diversification. This financial model revolutionizes project funding, company acquisitions, and management strategies, positioning private equity as a driving force in construction finance. As the construction industry evolves, private equity’s role is likely to grow, driving innovation and sustainability by leveraging financial resources, expertise, and networks. However, careful consideration of potential drawbacks and challenges is essential for maximizing the benefits of private equity investments.

22. Diversity and Inclusion

In 2025, the construction industry is placing greater emphasis on diversity and inclusion. Companies recognize that a diverse workforce, including a range of backgrounds, experiences, and skills, fosters innovation and addresses labor shortages by tapping into a wider talent pool.

Efforts to diversify include increasing the representation of women, who currently hold 10.8% of industry positions. From 2007 to 2018, there was a 94% increase in female-owned construction firms, and in 2018, 30% of construction companies promoted women to senior positions.

Additionally, the industry is targeting Gen Z, born between 1995 and 2010, in recruitment efforts. This generation is now more receptive to trade schools, especially after the COVID-19 pandemic shifted attitudes toward alternative education options.

Highlighting the career growth potential and opportunities to work with new technologies is key to attracting young talent.

Overall, these diversity and inclusion initiatives are essential for building a more vibrant and innovative construction industry, equipped to meet current and future challenges.

23. Proposal and Marketing Technology

The construction industry is increasingly leveraging digital marketing to reach new construction clients and enhance brand visibility. During the COVID-19 crisis, the global Digital Advertising and Marketing market value was $476.9 billion in 2022. It is forecasted to grow to $786.2 billion by 2026, achieving a compound annual growth rate (CAGR) of 13.9% throughout the period analyzed.

The rise of digital platforms offers construction companies innovative ways to showcase their projects, engage with potential clients, and generate leads.

From SEO and social media marketing to a strong construction website and content marketing, digital marketing strategies are proving essential in the competitive construction market. This upward trend is transforming how construction companies connect with their audience and stay ahead in the industry.

Alongside marketing, proposal technology is becoming a differentiator for AEC marketers. Tools like Shred.ai are redefining how firms approach proposal writing by using AI to automatically compile project data, images, and resumes into polished drafts. This reduces the time teams spend on repetitive administrative work and ensures proposals are consistent, accurate, and client-ready.

As digital adoption accelerates, the integration of marketing platforms with proposal automation tools represents the next evolution in construction technology. Together, they empower firms to both win new work more efficiently and build stronger, more memorable brands.

| Hand-picked related content: Learn how you can win more business through your marketing efforts by reading our blog that tells you How to Create a Construction Marketing Plan. |

The Future of the Construction Industry

As we look ahead, the construction industry is set to undergo transformative changes driven by key construction industry trends such as advanced building materials, connected construction sites, and innovative technologies like 3D printing and AI.

Moreover, sustainability remains a core focus, with living materials and eco-friendly practices gaining traction. Embracing these construction industry trends will be crucial for staying competitive in the evolving construction landscape.

Additionally, the rise of construction technology trends, including software like Digital Asset Management (DAM), is streamlining project workflows and enhancing collaboration by efficiently managing and sharing digital assets. This saves you time and money while helping you win more business.