2021 United States Construction Industry Survey

Oct 13, 2021

Despite a challenging year, construction firms are largely on track to meet or exceed their goals for 2021. To better understand the state of the construction sector, we leveraged a third-party research firm to survey 500 construction firms around the country.

U.S. Construction Industry Statistics 2021

Here we discuss key takeaways from our survey, compare our findings with reputable industry studies and provide insight into how construction firms are responding to new challenges in 2021.

Survey Finds Stress and Opportunity in Construction Sector

Our survey of 500 construction firms shows that U.S. construction firms in 2021 are overworked, understaffed and increasingly reliant on technology solutions to better manage their time and digital assets.

The following insights from the survey show that firms who embrace digital asset management (DAM) can improve operational efficiency, increase productivity and better prepare for the future.

75% of Construction Firms Will Meet or Exceed Their 2021 Goals

Having weathered the Covid-19 pandemic relatively unscathed, “the U.S. construction industry is projected to grow by 1.8% in 2021 and 3.1% in 2022, before it moderates to an annual average growth of 2.2% over the remainder of the forecast period,” according to the United States Construction Market Trends and Opportunities Report for 2021-2025.

The report aligns with the findings from our survey, which shows that two-thirds of U.S. construction firms say they have met their goals in the first half of 2021.

58% of Construction Firms Report Higher Stress Among Staff

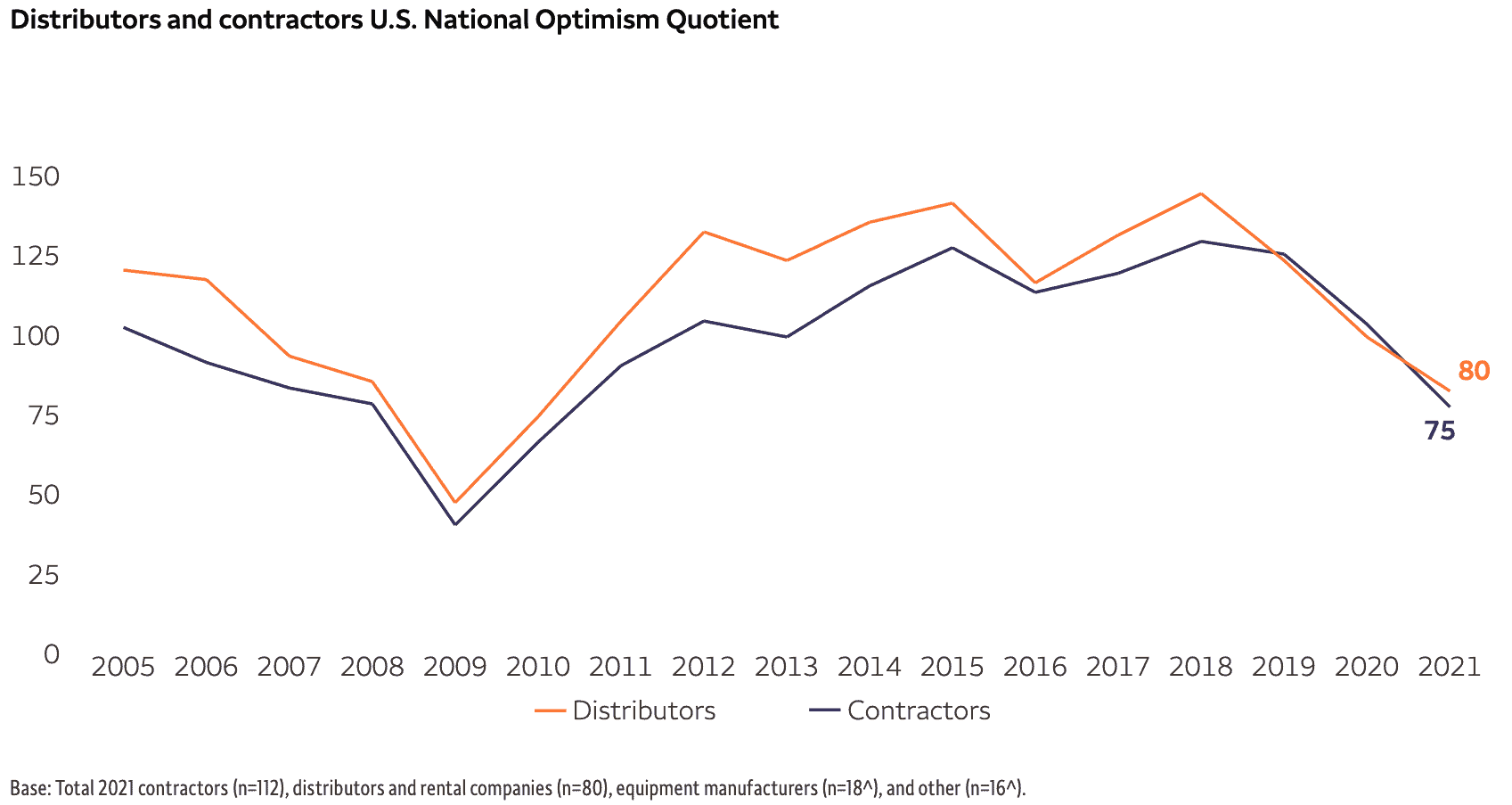

Despite meeting their goals, 58% of construction firms report feeling more stressed and less optimistic than usual. Among executives, a Wells Fargo 2021 Construction Industry Forecast reveals a sharp decline in optimism over previous years.

Though factors like the Covid-19 pandemic certainly contribute to the stressful environment, more than half of firms we polled blame the industry’s notoriously tight deadlines and insufficient staff numbers.

39% of Construction Firms Can’t Access Their Digital Assets

Even with access to the latest technological solutions, 39% of construction firms say they can’t access the digital assets they need (photos, presentation templates, videos, etc.) to share progress, create collateral and submit bids on time.

In other words, construction firms are overworked, under-staffed and constantly pressed to do more with less in half the time. Unfortunately, the limits of their tech stack hinder their ability to work efficiently and contribute to the high-stress nature of the job.

81% of Firms Expect to Manage More Digital Assets in 2022

81% of firms who participated in our survey said they manage between 5,000 and 100,000 photos in 2021 and expect to manage more digital assets in 2022. In addition to images, these digital assets include:

- videos,

- design files,

- word documents,

- PDFs,

- branded material,

- presentations, and

- marketing content.

Unfortunately, survey respondents also report that these valuable digital assets are often inaccessible, outdated and hard to find. In fact, 89% percent of AEC firms report spending half a day or more each week managing images. One tool that helps firms manage these disparate digital asset issues is digital asset management software (DAM), which enables firms to manage images with greater ease and efficiency.

80% of Firms Say They Have Difficulty Filling Hourly Positions

A 2019 survey conducted by Autodesk and the Associated General Contractors of America (AGC) found that 80% of firms have difficulty filling hourly positions. The pandemic only exacerbated the industry’s persistent labor shortage, with 44% of firms citing labor shortages due to the Covid-19 virus and related concerns.

Fortunately, research shows that firms who leverage digital technologies are not only more efficient, they are better prepared for the future of work. Among construction firms we polled, those who leverage a digital asset management solution report improvements in efficiency, productivity and their ability to manage projects.

82% of Firms Feel They Need More Collaboration

Despite the widespread adoption of digital technologies in the construction sector, a study by KPMG found that 82% of AEC firms feel they need more collaboration with their team and contractors. Fortunately, our survey found that nearly half of respondents using a DAM solution cite faster turnaround on RFPs and increased utilization of billable staff.

These findings are corroborated by the 2021 engineering and construction industry outlook compiled by Deloitte, which found an increase in connected technologies and associated investments may help firms realize new operational efficiencies.

89% of Firms Agree. It’s Time To Embrace Digital Technologies

The labor shortage in the AEC industry not only exacerbates the ongoing skills gap in the era of digital transformation, it creates a mismatch between available employees and necessary skills. This situation is likely to negatively affect construction firms who don’t embrace productivity-enhancing technologies.

In fact, among survey respondents, only 11% of firms (those already using DAM) could quickly manage their digital assets. The other 89% of firms strongly agree that implementing a DAM solution would increase the overall efficiency of their staff and reduce their level of stress.

Digital Asset Management Top of Mind For Construction Firms

Digital asset management and other digital technologies are now top of mind for construction industry executives. Moreover, digital asset management solutions like OpenAsset have become an essential tool for marketers charged with the promotion of AEC brands and winning new business. Designed for firms in the built world, OpenAsset is the preferred project-based DAM solution for Architecture, Engineering, Construction and Real Estate firms across the world.

Get Started With OpenAsset Today

Follow the link for more insights from the OpenAsset 2021 Construction Industry Survey or schedule a demo of OpenAsset with one of our solution experts. Don’t forget to follow OpenAsset on social media for exclusive offers and valuable insight for AEC and Real Estate firms.